Victorians paying to build new homes are spending hundreds of thousands of dollars of their budget on taxes and government red tape.

Victorian home buyers are being slugged $373,000 in tax and red tape for the state’s typical new house, with the government accused of fomenting “house and tax packages”.

New data from the Centre for International Economics commissioned by the Housing Industry Association has also revealed new home buyers are facing the extraordinary slug of taxes paid on taxes, compounding the cost of building new homes at a time when governments at all levels claim to be doing all they can to remedy the nation’s housing crisis.

The massive government impost is being described as a key part of why Victorians are preferencing buying existing homes over helping to address the housing crisis by paying to build new ones.

RELATED: Foreign buyer ban blasted as ‘political theatre’ for Melbourne

Brutal reality Melbourne tenants face saving for a home revealed

Suburbs with best annual average growth revealed

It comes as separate analysis by money.com.au has revealed the state now has a more than $11,000 “new home premium”, with the $641,882 average loan for a new house in Victoria now far above the $630,498 typical loan for an established residence.

The federal government has claimed improving housing affordability is a priority, announcing multiple initiatives aimed at building 1.2 million new houses in the next five years.

Victoria’s Allan government has done the same, announcing plans to build 800,000 homes in the space of a decade in order to remedy the state’s housing crisis.

But the research shows Victorians have faced a massive $157,000 housing tax hike in the span of six years, with the share of a typical $866,000 new four-bedroom, two-bathroom house going to government coffers or regulatory requirements rising from 37 per cent to 43 per cent since 2019.

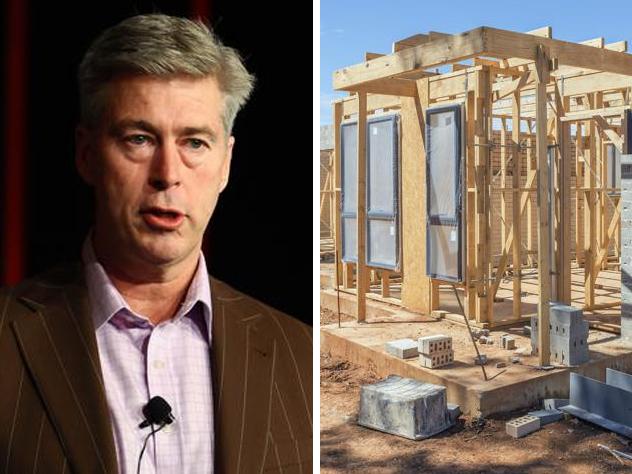

Home under construction Picture: istock

The increase means it now takes a typical homebuyer close to a decade to pay off the government for the chance to build their part of the great Australian dream, and the sky-high taxes also add to the costs in interest repayments to lenders over the life of a loan.

It’s one of the biggest increases in the nation, and on a par with NSW, though in Queensland the tax impost has more than doubled to $179,000 in the same timeline.

The $373,000 added to the cost of building by red tape and government fees in Victoria includes about $154,000 in regulatory costs, $193,000 in statutory taxes and $27,000 in infrastructure contributions.

The research tracks the typical costs incurred in building a four-bedroom, two-bathroom, two-carpark home.

HIA chief economist Tim Reardon said the research showed that despite claims to have housing as a top priority, governments at all levels were just paying lip service to the housing crisis “given the volume of taxes, charges, regulations and delays they impose on building”.

“With government taxes, fees and charges so high, the term ‘house and land package’ may as well be changed to ‘house and tax package’,” Mr Reardon said.

“Taxes and government charges have more than doubled, but housing supply has not. This points to the fact that governments cannot tax their way out of fixing the housing supply problem.”

HIA Chief Economist Tim Reardon has accused the government of fomenting ‘house and tax packages’ instead of ‘house and land packages’.

The economist said part of the costs passed on to buyers included GST paid to civil works specialists preparing land for development as well as the land tax paid to hold onto the land while increasingly lengthy regulatory requirements were ticked off.

Mr Reardon said this meant new homebuyers’ end stamp duty payment was often significantly raised by taxes that had already been paid earlier on in the building cycle.

“It’s multiple compounding taxes,” Mr Reardon said.

The money.com.au analysis of lending data shows that building material cost increases and even first-home buyer grants, as well as the taxes and government charges, were contributing to a “new build premium” that was now at its worst level since September 2019.

At that time the average Aussie loan for a new house was $475,844, while for an established home it was $464,850.

The firm’s property expert Mansour Soltani said for homebuyers it was inevitable that if building new became more expensive, “at some point the cost becomes just not viable” and homebuyers focused their attention on established homes.

Lending figures show Victorians are already paying an $11,000 premium to get a newly built home instead of an established property.

With an almost $30,000 (6.4 per cent) premium in the Northern Territory, a $23,000 (3.6 per cent) added cost in Queensland and Victoria’s typical new home loan almost $11,000 (1.8 per cent) above that of an established property mortgage.

Mr Soltani said those states were already likely at the point where buyers were turning their back on new builds.

“I do think this is having an impact on buyers around the country, and it will also create a divide for people wanting to sell a new property as they will want to get that premium back,” he added.

“The government is going to have to cut red tape and cut costs, it’s got to come out of their slice of the pie, that’s the only way.”

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: ‘Bulletproof’: where Melb home price has risen 1300%

Victorian tenants facing toughest times in 15 years: PropTrack Rental Affordability Index

EPA reveals Melbourne’s smelliest suburbs from Cranbourne to Brooklyn