The average Australian property investor will lose money in their first year, with those in the nation’s two largest capitals likely to be more than $23,000 out of pocket in just 12 months.

With a mix of stamp duty and land tax outstripping rental returns and major capitals thought to be approaching home value peaks, in many cases it could be years before landlords turn a profit.

Figures showing just how much investing costs in the first year of ownership by Property Investors Council of Australia director Ben Kingsley have been released along with a warning over any further consideration of scrapping negative gearing at the next federal election.

RELATED: Property guru says Aussies ‘on edge’ as 2025 approaches

Grim outlook for Melbourne housing market in 2025 laid bare

His figures show that after 12 months owning a $937,289 investment in Melbourne, out of pocket expenses are likely to leave an investor there $26,798 in the red — the worst figure in the country.

A home like 26 Sunny Vale Drive Langwarrin, on the market for $920k-$995k – falls within the typical Melbourne home price bracket.

The loss is calculated based on a 3.1 per cent rental return of about $29,056 a year being deducted from a $53,717 stamp duty bill and $2137 in land tax.

Despite a far higher $1,441,957 median house value that added almost $10,000 more in stamp duty to the typical Victorian figure, Sydneysiders are slightly better off with an expected $23,762 loss.

The bleak calculations from Empower Wealth boss and PICA director Ben Kingsley show at the end of the past financial year, investors just buying in would have been poised to incur losses across almost every major capital.

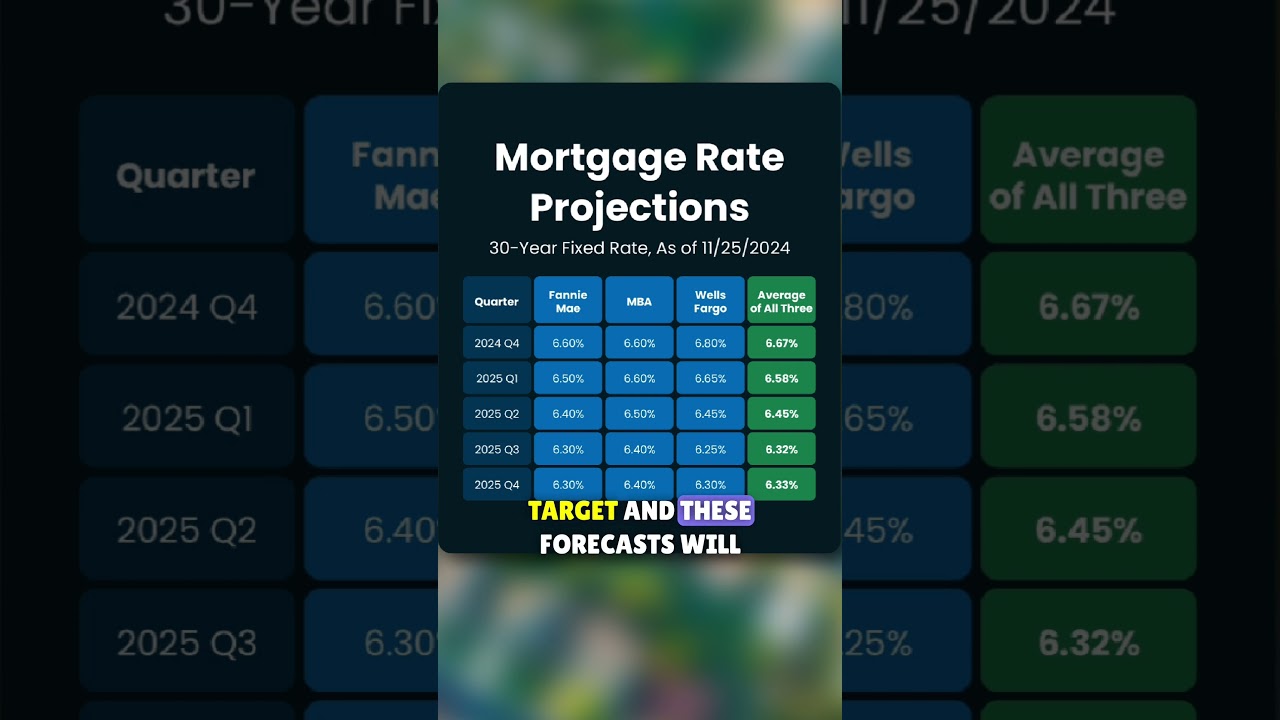

FIRST-YEAR INVESTMENT PROFIT ESTIMATES BY CAPITAL CITY

Sydney: -$23,762

Melbourne: -$26,798

Brisbane: -$5114

Adelaide: -$17,144

Perth: $1155

Hobart: $783

Darwin: $6393

Canberra: -$6244

Estimates do not factor in capital growth, interest costs, property management fees or tax adjustments due to high variability

Source: The Property Couch Podcast

In Adelaide the $811,059 typical house purchase would leave an investor $17,144 out of pocket a year on, while in Brisbane there would be a $5114 shortfall after investing in the city’s $937,479 median home price.

With Canberra also taking a loss, only Perth, Hobart and Darwin were in the black.

Mr Kingsley said while some investors might expect to take a loss in their first year, few would expect it to be in the tens of thousands of dollars.

105/10 Nicolle Walk in Haymarket, NSW has recently hit the market priced between $1.4m-$1.5m – around Sydney’s median property price.

Ben Kingsley is the chairman of Property Investors Council of Australia and co-host of The Property Couch podcast.

While rising investment lending would seem to suggest many were taking this on, the property pundit noted that the data did not distinguish between commercial and residential investments — and he believed it was likely there was substantial growth in people buying industrial, retail and office assets that offered more favourable conditions for landlords.

The property pundit said that over five years in most capitals the losses would be covered by capital gains for people buying a home with a traditional deposit. But for those leveraging equity in their own home to do so, rather than putting down cash, it was probable they would take longer.

40 Ferdinando Street, Pallara, Qld, which fell between $900k-$950k bracket on realestate.com.au, has recently gone under offer.

“If your capital gains return is 5-6 per cent in Sydney, those numbers look okay,” Mr Kingsley said.

“But we know Sydney has run out of puff. And Melbourne is retreating.”

He added that while traditionally reaching 55-65 per cent equity in a home had meant Australians were neutrally geared or making a profit, rising tax burdens were extending this timeline, particularly in Victoria.

Mr Kingsley noted that in addition to high taxes, Melbourne rents were “20 per cent below market value” when compared to Sydney and Brisbane — exacerbating the city’s low attractiveness to investors.

“Melbourne is the worst, just because of taxation,” Mr Kingsley said.

“But that’s not including the extra minimum rental standards requirements.”

7 Waratah Close, Belair in SA has recently gone under offer, priced between $810k-$870k.

While Victoria’s rental market settings were problematic, Mr Kingsley warned that with investment properties in most state capitals unable to be profitable in the first year or even two of ownership any fiddling with negative gearing could have disastrous consequences.

“You have zero incentive to buy an investment if they take away negative gearing,” Mr Kingsley said.

“This is tens of billions of dollars being invested every year by small, private rental accommodation providers — and without that, who pays?”

He warned this could cause crashes in the property market, a chronic shortage of rentals, and become “critical in a political sense” as it could end up with them being forced to put rent freezes in place — which would further alienate investors.

Longer term, if rental shortages grew worse it was likely it could start to impact major employers as they struggled to find talented workers willing to enter a challenging rental market to relocate for a job.

Cost Analysis Snapshot for Houses, from Ben Kingsley for The Property Couch Podcast.

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.